- PCI SSC (Payment Card Industry Security Standard Council) - an independent organization formed in 2006 by payment organizations to create and manage consistent security standards across all environments/applications where payment cardholder data is processed/processed/retained. Currently, the Council's membership includes all major payment brands (American Express, Discover Financial Services, JCB International, MasterCard, VISA Inc., UnionPay).

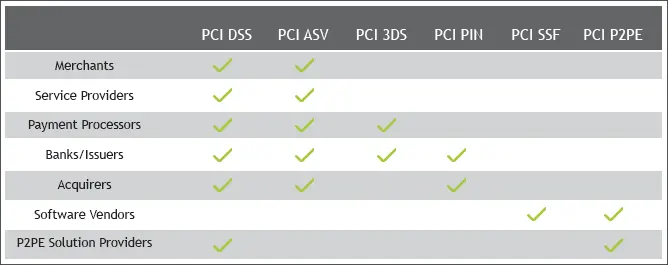

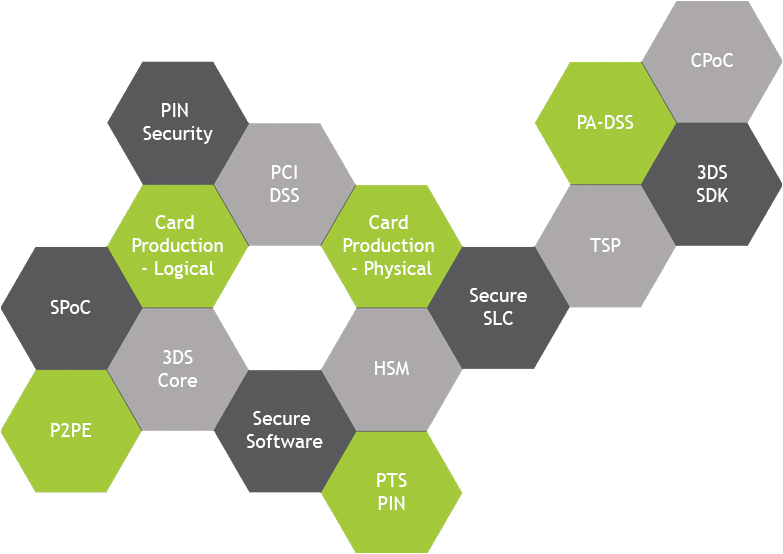

- PCI DSS (Payment card Industry data Security Standard) - covers security of the environments that store, process or transmit account data. Environments receive account data from Payment applications and other resources (e.g. acquirers).

- PCI PA-DSS (Payment Card Industry Payment Application Data Security Standard) - covers secure payment applications to support PCI DSS compliance. Payment application receives account data from PEDs or other devices and begins payment transaction (standard retires in 2022).

- PCI SSF (Payment Card Industry Software Security Framework) - is a collection of standards and programs for the secure, design and development of payment software.

- PCI PTS (Payment Card Industry PIN Transaction Security) - covers device tamper detection, cryptographic processes and other mechanism used to protect the PIN.

- PCI P2PE (Payment Card Industry Point-To-Point Encryption Standard) - covers encryption, decryption, and key management for point-to-point encryption solution.

- PCI PIN Security (Payment Card Industry PIN Security Standard) - covers secure management, processing and transmission of personal identification number (PIN) data during online and offline payment card transaction processing.

- PCI 3DS (Payment Card Industry 3DS Core Security Standard) - defines physical and logical security requirements and assessment procedures for entities that perform or provide the following functions, as defined in the EMV 3-D Secure Protocol and Core Functions:

3DS Server (3DSS)

3DS Directory Server (DS)

3DS Access Control Server (ACS)